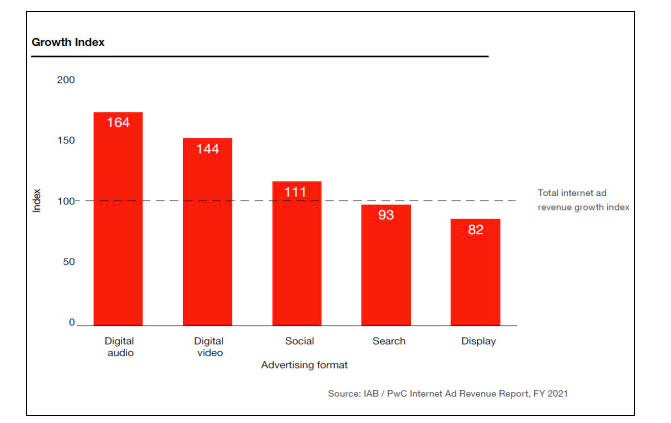

Digital advertising and consumption continues to grow, but no segment grew faster in 2021 than digital audio. The newly released IAB Internet Advertising Revenue Report finds digital audio ad spending soared 57.9% to $4.9 billion. And digital audio’s share of total digital revenue ad pie expanded too, as its share grew slightly from 2.2% in 2020 to 2.6% in 2021.

The report, which PwC prepares for the Interactive Advertising Bureau, covers podcasting, streaming radio, and digital music services. It shows that not only did digital audio have the fastest rate of growth of any online segment, but its gains were twice that of display advertising. Digital audio’s 2021 growth rate was also substantially larger than the 2020 increase of 13% which the IAB says is consistent with the 55% growth rate that the industry had been expecting in 2021 prior to COVID-19.

The IAB did not detail podcast-specific revenue figures — those will be part of a separate report released next month — but it says podcasts will “continue to drive growth in digital audio revenue” in the years to come, noting PwC projects monthly podcast listeners in the U.S. are anticipated to grow at a 6.7% annual rate from 2021 to 2025.

“What’s underneath these numbers is a very clear narrative. We are witnessing the total and complete democratization of access afforded by ad-supported digital channels,” said IAB Chief Executive David Cohen. “Increased consumer usage coupled with extraordinary growth of small and mid-sized businesses during the pandemic has fueled growth across all digital — but especially digital audio and video.”

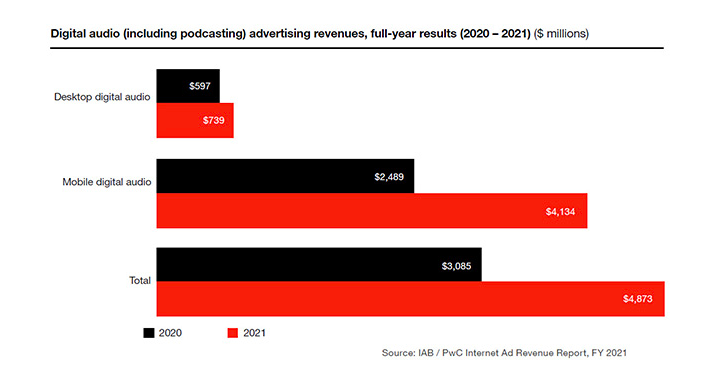

There was growth to be had all around for digital audio, with desktop digital audio ad spending rising 24% year-over-year to $739 million. But as the impact of the pandemic lessened last year, the majority of the growth came on mobile ad spending, which grew by two-thirds (66%) to $4.1 billion. Mobile’s share of digital audio revenue also increased to 85% from 81% year-to-year.

“Just like other ad formats, digital audio ad revenues are growing faster on mobile devices compared to the desktop,” the report says.

Mobile advertising overall reversed a three-year trend of decelerated growth last year as spending jumped 37.4% to a total of $135 billion. The IAB says the proliferation of mobile video and gaming, as well as the continued adoption of mobile e-commerce, were key contributors to the growth of increased revenue streams.

“The proportion of desktop versus mobile ad dollars remained consistent with roughly $7 out of every $10 ad dollars being allocated to mobile,” the report says. “This levelling off of proportional growth is a sign of continued stability in revenues across devices. It also may reflect the reality that many consumers allocated significant amounts of time consuming internet-enabled experiences through desktop, CTV, console, and other non-mobile formats, partly due to consumers being confined to their homes in 2021.”

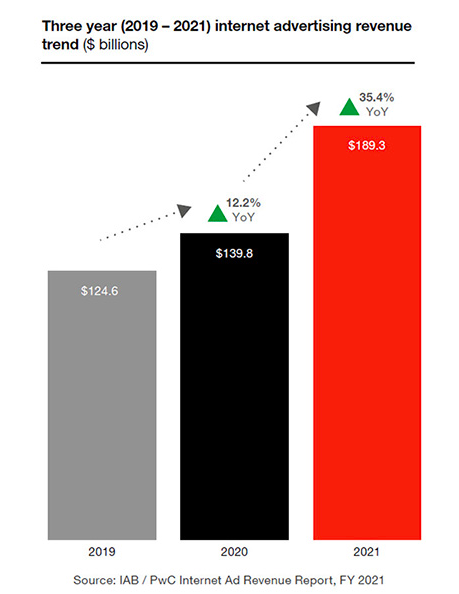

Overall digital ad spending soared 35% last year in the U.S. to $189 billion according to IAB. That $50 billion year-to-year increase was the highest growth rate recorded for digital ad spending since 2006 as an economic tailwind meant spending increased significantly compared with a year earlier, not only on digital audio but also across digital video (including CTV/OTT), social media, and search. The IAB report says the rapid acceleration exceeded Wall Street expectations and has shown the reliance of the U.S. internet advertising industry coming out of the pandemic.

“We fully expected 2021 to be an exceptional year for digital ad growth, but even we were surprised at the degree of acceleration. Not only was every single digital channel up, but some were up more than 50% year on year,” said IAB Chief Strategy Officer Libby Morgan. “This year’s increase is three-times what it was last year.”